By Newspot Nigeria Editorial Board

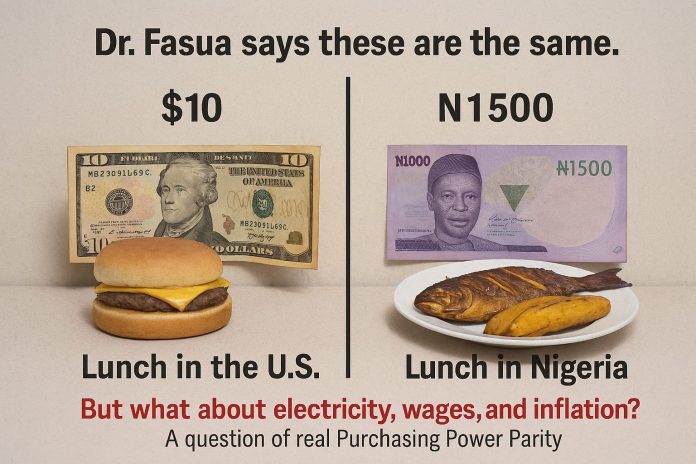

Special Adviser to the President on Economic Affairs, Dr. Tope Fasua, recently claimed on the MicOnPodcast that “$10 can’t buy lunch in the U.S., but $1 feeds you in Nigeria.” He made this remark in defense of the naira’s strength under the framework of Purchasing Power Parity (PPP). While the concept he referenced is legitimate in economic theory, his conclusion is misleading and overly simplistic.

At Newspot Nigeria, we respect intellectual honesty—and that includes challenging economic spin with the weight of lived reality.

PPP Is Useful—But Context Is Everything

Dr. Fasua is right that PPP helps explain how much goods and services cost in one country compared to another. Indeed, a meal that costs $10 in the U.S. might have a local equivalent in Nigeria priced at ₦1,500. This reflects the idea that things are cheaper in Nigeria, and so the naira still has value locally, even if it’s weak internationally.

But here’s where the argument breaks down.

- PPP Doesn’t Mean the People Are Comfortable

Nigeria’s minimum wage is ₦70,000/month, or around $46 using the current exchange rate. In contrast, the U.S. minimum wage is over $1,200/month. That’s not a purchasing power gap—it’s a survival gap.

A better PPP doesn’t help if people don’t earn enough in the first place. What’s the point of cheap meals if most citizens can barely afford them?

- Electricity is the Hidden Price Tag

- A major flaw in Dr. Fasua’s example is the omission of the power supply. In the U.S., that $10 lunch benefits from constant electricity, clean water, and working public systems. In Nigeria, a ₦1,500 meal often requires extra spending on:

- Fuel or diesel for generators,

- Water from private boreholes,

- Refrigeration powered by inverters.

- A major flaw in Dr. Fasua’s example is the omission of the power supply. In the U.S., that $10 lunch benefits from constant electricity, clean water, and working public systems. In Nigeria, a ₦1,500 meal often requires extra spending on:

So, while a meal may seem cheap on paper, its real cost is subsidized by personal suffering and private infrastructure.

- Inflation Destroys Purchasing Power

- Today’s boli and fish for ₦1,500 may cost ₦2,500 next month. Nigeria’s inflation rate is among the highest in the world, and PPP doesn’t account for that erosion of real value. Every week, Nigerians find that their naira buys less and less—so what exactly are we celebrating?

- Quality and Access Matter

- PPP assumes we’re comparing equal quality across borders. But in practice, that ₦1,500 meal isn’t the same as a $10 one in terms of:

- Hygiene

- Nutrition

- Service

- Infrastructure

- PPP assumes we’re comparing equal quality across borders. But in practice, that ₦1,500 meal isn’t the same as a $10 one in terms of:

Even worse, many Nigerians don’t have access to quality schools, healthcare, or transport—basic public goods that PPP calculations often overlook.

Don’t Dress Theory as Reality

We commend Dr. Fasua for trying to bring an economic lens to public discourse. But PPP cannot be used to paint a rosy picture while people are sweating through blackouts and borrowing to eat. Numbers mean little if they don’t translate into lived dignity.

The naira may feed you. But can it house you, heal you, or light your home?

That’s the real question. Until public policy answers that honestly, no parity—purchasing or otherwise—can justify the hardship on Nigerian streets.

Newspot Nigeria stands for truth, clarity, and accountability. We urge our public officials to step outside economic classrooms and walk through the reality of the people they serve.

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com