In the fast-paced world of corporate finance, making informed decisions is crucial for strategic success. However, as Tim Koller’s recent article highlighted, cognitive biases can significantly hinder this process. For CFOs and organizational leaders, understanding and addressing these biases is not just beneficial—it’s essential for fostering a culture of effective decision-making that aligns with long-term value creation.

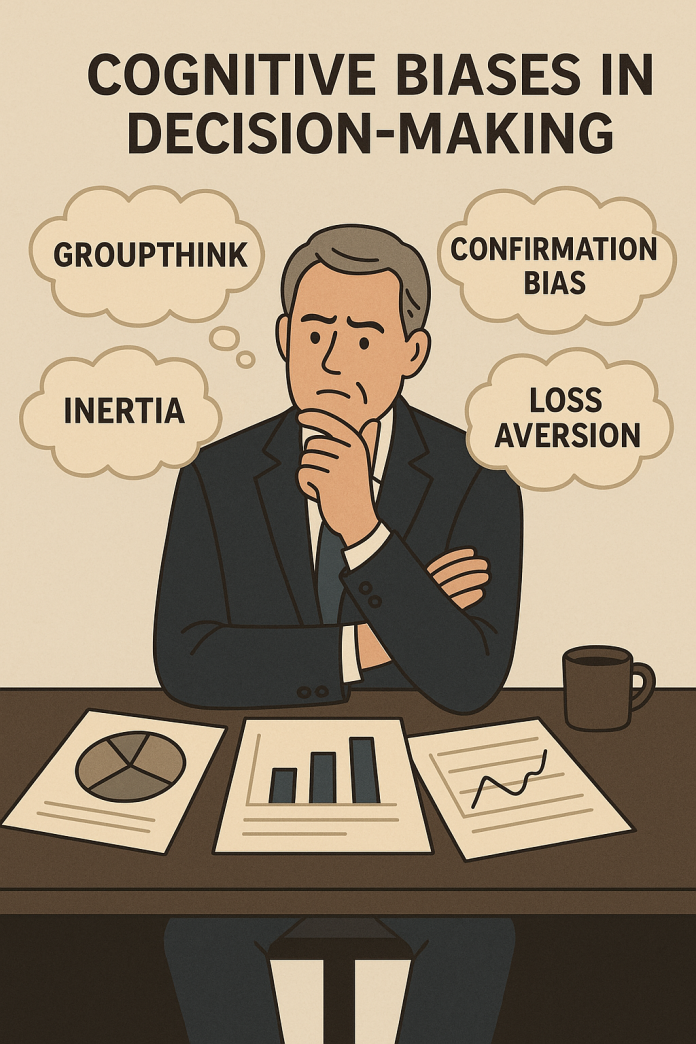

One of the most prevalent biases is groupthink, where the desire for harmony within a team leads to suboptimal decision outcomes. This phenomenon can stifle innovative ideas and critical discussions, as members may hesitate to voice dissenting opinions. Koller suggests implementing practices such as assigning a devil’s advocate or encouraging diverse perspectives to break this cycle. By creating an environment where rigorous debate is not only accepted but encouraged, organizations can enhance the quality of their decisions.

Another significant bias is confirmation bias, where decision-makers unconsciously seek information that supports their pre-existing beliefs. This can lead to overconfidence and the misallocation of resources. To combat this, techniques such as conducting premortems—where teams envision potential failures—can help identify flaws in plans before they are executed. By fostering a mindset that actively seeks disconfirming evidence, organizations can make more balanced and rational decisions.

Inertia is yet another barrier organizations face, as established processes and past allocations often dictate current decisions. Koller emphasizes the importance of ranking initiatives based on their potential value creation rather than historical spending patterns. This approach encourages organizations to innovate and adapt rather than cling to outdated practices.

Finally, loss aversion plays a critical role in decision-making, as individuals tend to fear losses more than they value potential gains. This bias can lead to reluctance in pursuing risky yet potentially rewarding projects. Koller advocates for a shift in perspective, urging leaders to assess investments based on their overall contribution to the organization’s risk profile rather than viewing them in isolation.

By acknowledging these cognitive biases and implementing strategies to mitigate their effects, CFOs can enhance their decision-making processes. The journey towards better corporate governance and strategic alignment is ongoing, but the insights from Koller’s analysis provide a valuable roadmap for leaders aiming to navigate the complexities of organizational decision-making.

In conclusion, as organizations strive to create value in an increasingly competitive landscape, the importance of addressing decision-making biases cannot be overstated. By fostering a culture of open dialogue and critical thinking, CFOs can lead their organizations toward sustainable success.

For more insights on corporate finance and decision-making strategies, stay tuned to Newspot Nigeria.

Source: McKinsey & Company

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com