The Central Bank of Nigeria yesterday hiked the MPC rate, and this move has significant implications for both Nigerian citizens and business owners.

In simple terms, the MPR rate is the rate that banks and other financial institutions (OFI) use to set their own interest rates.

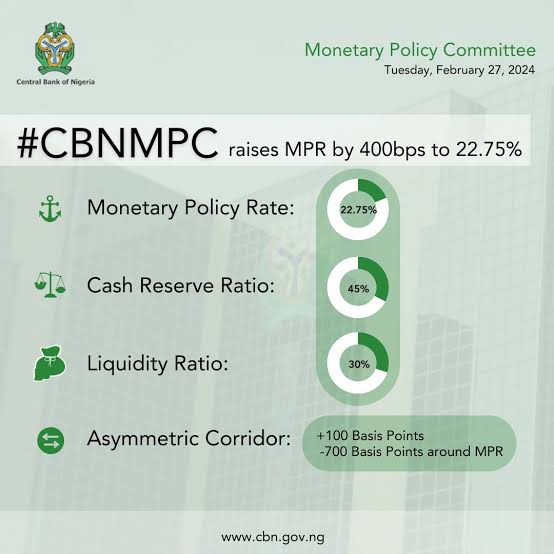

Before, the MPR rate was 22.75%. The MPC just increased to 24.75%.

Let me explain what this means:

If you step into Zenith Bank to collect a loan as a small business owner or an individual this morning, they are going to use their own methodology plus 24.75% to arrive at the actual interest rate they will charge you if you borrow.

Before, the bank interest rate on borrowing was around 29% to 35%, but now, expect the rate on bank loans to hover between 35% and 40%.

The purpose of this is to discourage people and businesses from borrowing from the bank, thereby reducing cash in circulation.

There are companies and businesses out there that borrow billions of naira from the bank.

Imagine borrowing N5 billion with a 40% interest rate, which means you will pay 2 billion naira in interest aside from paying the N5 billion loan back to the bank.

That is crazy.

This means that, unless absolutely necessary, companies would reduce borrowing.

If companies decide to reduce borrowing, it means they won’t have cash at their disposal to spend on a lot of things, like promotions and marketing.

If there is no cash to spend on a lot of things, demand in the market for their products will reduce. A decrease in demand will further affect the prices of commodities, thereby reducing inflation.

A lack of cash in circulation reduces inflation; at least you can attest to that fact when the cashless policy was in effect in January 2024.

Another way to reduce cash in circulation is to incentivize people to invest the money they have so that they can get huge returns.

A high interest rate of 40% means high investment returns.

For instance, Visage Media has N5 billion in our corporate bank with UBA that we don’t have an immediate need for. We can easily call the UBA bank manager and ask him how much the interest would be if we fixed that N5 billion in a fixed deposit.

If the interest rate for the fixed deposit before today was 15% after this MPR hike, rest assured that the interest you will get on a N5 billion fixed deposit will be around 25% or even more, depending on your negotiation skills.

If the bank manager refuses to give you 25% interest or more on your cash, just wait for Treasury bills; you will get something higher.

The last Treasury bill auction was 23% for one year.

The logic is that the government is forcing you to lock up your funds by giving you an incentive to do so.

As you lock them up, we have less cash in circulation, thereby taming your frivolous spending.

Frivolous spending means less demand.

Less demand means lower price levels.

I used to tell people that in economics, what is good is also bad as well.

If I need to import cars for sale and my only option is to go to the bank to borrow the necessary funds, then that is where the wahala will start.

The bank will lend me funds for my imports or whatever I want to do with them with an interest rate of, say, 40%.

Due to the high interest rate, I must consider raising the price of my cars to meet my repayment plan for the funds I borrowed. This will result in my cars being more expensive, and it may take some time before I sell them due to decreased demand.

Imagine you work for the US and have $50,000 in savings,and you realise that Treasury bills are given 20% interest earnings.

As a smart investor, what will you do?

Change that $50k to Nigerian naira = 60 million at 1,200 to $1.

Invest that 60 million in Treasury bills, and you will earn 25%, which is 15 million per year.

After a year, cash out your 75 million and convert your funds to dollars at the prevailing exchange rate.

Do you know what I just did? I created a scenario that incentivizes foreign investors, called Foreign portfolio investors, to demand naira in exchange for dollars.

More and more demand for naira means stronger naira, and the exchange rate will be stable.

All this is part of the strategy for increasing MPR.

There are other benefits as well as demerits to increasing the MPR rate.

The benefits are:

Inflation will be tamed.

Nigerians have been complaining that things are expensive on the market.

So this MPR rate hike will solve the problem, as we will attract more dollars when foreign investors invest in fixed-market assets like Treasury bills.

When they exchange their dollar for naira to invest in Treasury bills or fixed deposits for high returns, the exchange rate remains stable because of liquidity of dollars which in turn drives down the price of market goods.

Another merit is that since money won’t circulate as before because the CBN wants to take money away from the hands of Nigerians and then force them to save so as to tame inflation, the traders in the market will be forced to reduce the price of their goods because less cash in circulation means only a few customers can afford to buy what they are seeking.

The dollar will be stable around 700–900 to $1.

The reason being that foreign institutional investors who will rush to invest in our fixed market, like Treasury bills and bank fixed deposits, will bring dollars, which CBN will use to create liquidity and support the naira.

These foreign portfolio investors have been arriving for the past month; as of March 8, they brought $2.3 billion, which the CBN used to clear our liabilities and backlog last week.

Now that the CBN Governor has hiked the MPC rate even further, we will witness an unprecedented inflow of dolllae from investors who want to make money investing in Treasury bills or fixed bank deposits.

All this is part of the strategy for increasing MPR.

The demerit is that we have sacrificed economic growth so we can tame inflation.

What it means is that

Companies and businesses will be forced to sack their staff and employees and cut down on expenses since the cost of borrowing from banks is too high. .

Less cash in circulation and more people out of work

This implies that an increasing number of individuals will fall into poverty due to circumstances beyond their control.

The high interest rate at the bank will force many businesses to close.

Not every business can afford to do business with a loan that has a 40% interest rate.

Because we have sacrificed growth over inflation, Nigeria will go into recession before the end of the year or the first quarter of next year, and this will come with the attendant hardship, hunger and misery for Nigerians ahead.

You get the point.

Let me cut it here, and let’s briefly look at CRR.

We adjusted the cash reserve ratio (CRR) from 32.5% to 45%. What does that mean?

It means if GtBank customers deposit 10 billion every day with the ban branches all the country, GTB has to compute 45% (N4.5b) and send it to CBN for safekeeping.

What will remain with them is just 55% (N5.5b), which is what they will use to give out loans.

Actually, the goal is to prevent the banks from having enough cash to even grant loans.

On one hand, you’re discouraging companies from borrowing because of the high interest rate; on the other hand, you’re forcing the bank to have a higher reserve, which will make them give out little to no loan at all.

Do you see the strategy😅😉

The next one is the liquidity ratio.

This means that the bank must always have a minimum LR of 30%.

This implies that the banks must hold N30 in their vaults for every N100 deposit in order to meet customers’ immediate withdrawal demands. This is to protect depositors.

The objective is that banks must at all times have enough money to give out to depositors in case they come to withdraw their hard-earned monies’.

The last one is the asymmetric corridor.

This involves a transaction between commercial banks and the central bank.

Some of you might not know, but there are transactions of borrowing and lending between commercial banks and central banks, and they involve interest rates too.

100 basis points = 1%

700 basis points = 7%

The MPR rate is 24.75%.

If GtBank wants to borrow money from CBN, then they will pay a 25. 75% interest rate (24. 75% + 1%).

GtBank may need to borrow money from CBN if they are facing problems of lack of liquidity or they need cash to solve an urgent 2K problem😉

On the other hand, if Gtbank has ample or excess cash and wants to deposit the cash with CBN to earn interest-on-deposit, then CBN will give them 15.75% (22.75%–7%) as deposit interest.

If I were the GtBank CEO, why would I take my excess cash to CBN to earn just a meagre 15.75%?

I would prefer to identify individuals in need of loans and provide them with loans at a rate of 30%.

The koko is where you will have excess cash. When your CRR is 45% and your LR is 30%.

We are living in unprecedented times. A rate hike is bad news anywhere in the world, including the US.

Politicians hate it because it is anti-growth, but the CBN Governor has run out of options for taming inflation, so a rate hike is the last card on the table.

The dollar will get stable before July. That is for sure.

Inflation will go down.

However, it will come with a price: as Nigerians, we have to sacrifice our comfort and growth this year in order to achieve this.

So brace up, my people, for the difficult days ahead.

-Chukwudi Iwuchukwu.

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com