-

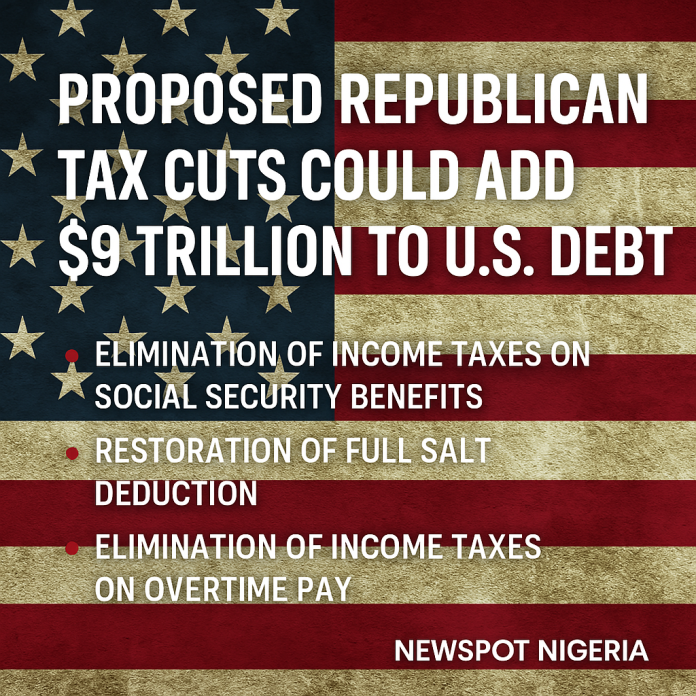

Elimination of income taxes on Social Security benefits: $1.4 trillion

-

Restoration of the entire State and Local Taxes (SALT) deduction: $1.2 trillion

-

Elimination of income taxes on overtime pay: $880 billion

-Peter G. Peterson Foundation

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com