By Charles Akinola

How fast things change. Yet “the more things change; the more they stay the same,” French writer Jean-Baptiste Alphonse Karr wrote in 1849. By this oxymoron, he sarcastically suggests that “even the most turbulent of changes do not affect reality on a deeper level other than to cement the status quo.” Will this be the fate of the ill-fated business partnership between Dangote Petroleum Refinery and Nigeria National Petroleum Company Limited, NNPCL?

Likewise, when Nnamdi Azikiwe led his Nigeria Peoples Party, NPP, into a political alliance with Shehu Shagari’s National Party of Nigeria, NPN, during the second republic, the flambouyant political ‘juggernaut’, Kingsley Ozumba Mbadiwe, popularly called K.O, baptized it “Accord Concordia”. Dangote Refinery’s agreement with Nigeria National Petroleum Company Limited, NNPC, was a business “Accord Concordia,” which like the NPN/NPP accord, may have fallen apart.

Furthermore, K.O, looked forward to every political battle with courage under a legendary combative paradigm, “When the come comes to become and we all come to close combat, we shall come out.” In the business relationship between Dangote and NNPC, “the come” has rather come to unbecome in just 27 days of turbulence.

Paul Coelho, 77-year-old Brazilian lyricist and novelist, philosophized about becoming, “Maybe the journey isn’t so much about becoming anything. Maybe it’s about unbecoming everything that isn’t really you so you can be who you were meant to be in the first place.”

This aptly sums up the ill-fated sole off-taker agreement between NNPC and Dangote Refinery for its premium motor spirit (PMS), popularly known as petrol in Nigeria. as the national oil company repudiated the agreement October 9.

By the agreement, NNPC received all petrol for domestic consumption and distributed it to marketers across the country. The NNPC said in September it was buying petrol from Dangote Refinery at N898.78 per litre and selling to marketers at N765.99 per litre, shouldering a subsidy of almost N133 per litre.

But there was uproar in the civic space that the national oil company was out to emasculate Dangote so it could continue its monopoly of the downstream sector. The company explained it receives the fuel and subsidizes it for the consumers to keep the price of petrol low but this was a hard sell. It was a hard sell because the filling stations were famished and Dangote Refinery held out a big promise of local capacity and a faint hope of lower prices.

Those who have followed the Dangote psyche laughed at what they said was a ‘baseless’ optimism predicated on ignorance. Dangote is a businessman focused on maximizing profit for his shareholders. He did not become the richest African by subsidizing his products. For instance, he promised local capacity for cement. He achieved it and gained a near monopoly at 61 percent control of the market but at a point a bag of cement went up as high as ₦15, 000. Today a 50kg bag of Dangote cement still sells for ₦7, 500 – ₦8, 000, depending on the location. The raw materials for the production of cement are locally available in Nigeria. It took a bitter price activism by the BUA Group and pressure from the government to beat down the price from ₦15, 000.

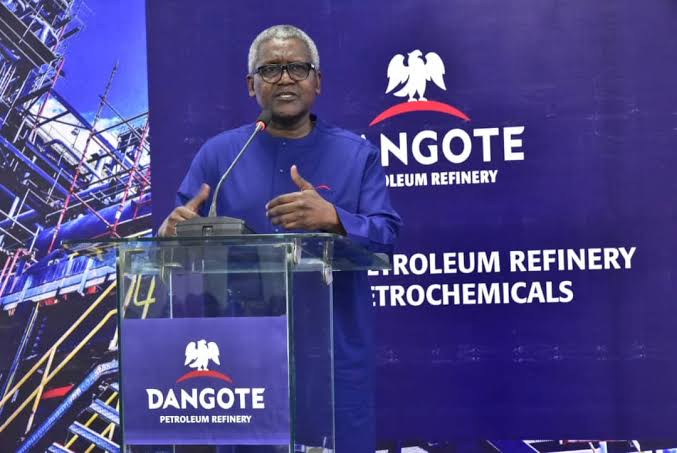

When production started at Dangote Refinery, he said in his address, “This is a big day for Nigeria. We are delighted to have reached this significant milestone. This is an important achievement for our country as it demonstrates our ability to develop and deliver large capital projects. This is a game changer for our country, and I am very fulfilled with the actualization of this project.” He identified NNPC, NUPRC and NMDPRA as “our dependable partners in this historic journey.”

Wale Edun, minister of finance and coordinating minister of the economy, leader of Federal government delegation on Sept 14, 2024 when Dangote started delivering PMS noted, “This refinery is producing PMS that is sufficient for the entire Nigerian market, with a surplus for export. We call on other domestic refiners to not only supply the local market but also to change the narrative by producing petroleum products for the sub-region and beyond. This will generate additional foreign exchange revenue for the betterment of the economy. We are thrilled that this day has arrived,”

Vice President of Oil and Gas at Dangote Industries Limited, Devakumar Edwin, enthused that the commencement of PMS production fulfilled Dangote’s vision of addressing energy supply challenges in Nigeria.

“If you consider the refinery’s capacity for PMS alone, processing 52,000 barrels of crude each day generates more than 54 million litres of PMS. Additionally, the refinery can produce other products. Specifically, 44 per cent of the refinery’s capacity can meet 100 per cent of domestic needs, while 56 per cent is allocated for export. It is indeed a massive refinery,” he said.

“It will not only substitute imports but also boost forex generation through export. We will save foreign exchange in two ways: first, by reducing expenditures on importing petrol, jet fuel, diesel, and other products, and second, through the revenue generated from exports.”

That was on September 14, 2024. Just 27 days later, things have fell apart. The poetry of the promise did not match the prose of non-delivery. From day one Dangote failed to meet its supply obligations. It was strongly alleged that substantial quantity of the initial crude allocated to the company for refining for domestic use was illegally exported. This was in spite of the poetry of being Afrocentric and champion for domestic self-sufficiency.

Since Dangote Refinery entered the market, ironically, most Nigerians have parked their cars due to the spike in fuel price from ₦617 to ₦926. Then on October 9, NNPC announced its withdrawal from the sole distributorship of Dangote Refinery petrol. The immediate market response was another spike in the pump price of petrol at NNPC filling stations to ₦1, 030 and ₦1,600 at the black market. The independent marketers are still waiting to get the first supply to determine how much to sell. Dangote Refinery is said to have increased its price two times in its 27 days operation.

Now that Dangote has come to judgement in the downstream sector of our oil industry, “the come has come to unbecome.” Things are falling apart at the filling stations and mere anarchy is loosed upon people’s pockets.

Citizens are wondering, why is Dangote’s fuel so costly with all the landing and associated costs removed? Of what benefit is Dangote Refinery to the citizens on the street if it leads to higher pump prices of fuel?

The argument was that allowing Dangote Refinery to sell directly to willing buyers will bring down prices. This can only happen if the company supplies at reasonable price, giving the preferential considerations from government.

Billy Gillis-Harry, President of Petroleum Products Retail Outlets Owners Association of Nigeria, doubts if Dangote Refinery will lead to lower prices. He said on Arise Television Wednesday, October 8, that willing-seller, willing-buyer will make the product available nationwide but it is not guaranteed to make it cheaper.

“If confirmed indeed that NNPC will no longer be the sole off-taker…the difference it will make will still be that petroleum products are available and we can have access as fast as possible. But as far as price is concerned, it is difficult for us to address that because as at today, we don’t know the price that Dangote is selling. We are aware of what NNPC is selling; we are aware of what NNDPRA is regulating but we need to know that. When we know that then prices can be a conversation that can come to the forefront.”

Despite looking like the villain, the hope of lower domestic fuel prices for Nigerians may still depend on NNPC, after all. As a state-owned oil company in search of relevance and profit for its shareholders, which are Nigerians, it transformed from a corporation into a limited liability company in July 2022. The Petroleum Industry Act (PIA) 2021, has enabled NNPC to carry out extensive reforms to make the group profitable like the international oil companies. From a deficit of ₦803bn in 2018 the company made a profit of ₦674bn in 2021.

To solve the now life-threatening challenge of domestic fuel availability and lower prices, NNPC has to make its four refineries functional, instead of hoping on a core capitalist like Dangote to help it out.

Its four refineries – two in Port Harcourt, one in Warri and one on Kaduna – have a joint installed capacity of 450,000 barrels daily; while Dangote has a capacity of 650, 000 b/d. About 159 litres of fuel can be extracted from one barrel of crude oil. This means that if NNPC’s four refineries are functional, the group can extract 71, 550, 000 litres daily. Nigeria’s average daily consumption is put at 66 million litres daily, which suggests that NNPC can indeed meet domestic needs and even expand its capacity to export and earn foreign exchange for the country.

From our investigation, NNPC has invested substantially in the revamp of its four refineries – ₦1.5bn for Port Harcourt refineries and ₦1.4bn for Warri and Kaduna. Port Harcourt is said to be nearly operationally ready; while Kaduna is at advanced stage. So now that NNPC is an efficient company, revamping its refineries is the best way to go. This will solve national conflicts and bring bigger profits

The Petroleum Industry Act (PIA) 2021, birthed a new commercially oriented national oil company governed by the Company & Allied Matters Act (CAMA). It charges NNPC with the responsibility of guaranteeing Nigeria’s energy security which is critical to national security. This should not be relinquished to third party commercial interests like Dangote Refinery.

The more, the merrier as Nigeria is a big market. Indeed, as more private refineries are expected to come on board, the presence of functional NNPC refineries will moderate their avarice and create a robust domestic market that will bring lower market driven prices and profit for shareholders. Their excess capacity can then supply the ECOWAS subregion and African continent.

The NNPC with assets of $153bn is the largest national oil company in Africa. It has extensive infrastructure and investment in the downstream, midstream and upstream of the Nigerian petroleum industry, which if well managed will continue to create wealth for Nigeria.

It then follows that Nigeria’s quest for energy sufficiency lies with the new NNPC, not Dangote, who unilaterally downgraded Nigeria’s 20 percent in Dangote Refinery to 7.2 percent at his convenience. Dangote has proved, as he did in cement, sugar and others, that he is more faithful to his pockets than to the average Nigerian on the street.

October 10, 2024.

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com