As part of the efforts to actualise the provisions of the Higher Education Act 2023, otherwise known as Students Loan Act, the Central Bank of Nigeria(CBN) and the Joint Admissions and Matriculation Board(JAMB) are interfacing with a view to fashioning out modalities for speedy disbursement to beneficiaries.

It will be recalled that President Bola Tinubu recently signed into law a Bill that provides interest-free education loans for Nigerians willing to acquire tertiary education while they pay in instalments two years after their participation in the National Youth Service Corps (NYSC) programme.

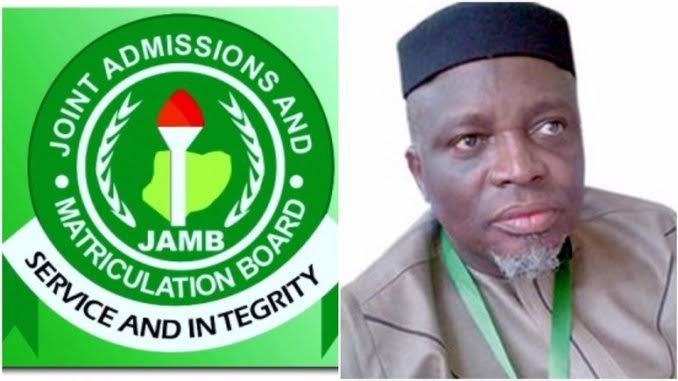

The Central bank of Nigeria in a meeting with JAMB at the Board’s National Headquarters in Bwari on Thursday, 12th September, 2023, said JAMB as a critical stakeholder is to provide the requisite database of eligible students who had enrolled in Nigerian tertiary institutions as part of the verification process for accessing the loan. Mr.Oyeleke Abayomi, Deputy Director, Central Bank of Nigeria (CBN) who represented the CBN at the high-powered meeting commended the JAMB team for its prompt response despite the short notice.

He stated that the students loan scheme scheduled to commence with effect from 1st October, 2023, would be in phases noting that while there were stakeholders such as the Federal Ministry of Education, tertiary institutions and their regulatory agencies listed in the Act, the responsibility of the CBN, according to him, was to develop an application to operationalise the disbursement of the loan.Mr. Abayomi, therefore, stated that they came to JAMB to seek partnership in ensuring the smooth running of the loan scheme, get the best means of validating the eligibility of students admitted into tertiary institutions vis-a-vis data supplied by applicants.He explained that every interested Nigerian students are to login and register for the loan while CBN verifies the citizenship and admission status of the applicants, adding that the loan is to cater for tuition and upkeep.In his remarks on the occasion, the Registrar, Prof. Is-haq Oloyede, represented by Director of Finance and Accounts, Mr. Mufutau Bello, thanked the visitors for their kind remarks and for partnering with the Board in the implementation of the scheme. He commended Mr President for initiating such a thoughtful policy as he pledged the support of the Board in providing all data related to admission of students that would be required for the success of the initiative.During the meeting, both parties discussed a wide range of issues bordering on acceptable means of verification, the Central Admissions Processing System (CAPS) as a means of applicants’ status verification, usage of UTME registration number provided by JAMB to serve as a unique identifier, the role of the National Identification Number(NIN) in the operational processes of JAMB, the functionality of payment of students loan into the account of parent’s institutions rather than their affiliates and the modalities for effecting a transfer of beneficiary if need be, among other issues.

At the end of the interface, the two bodies resolved that CBN should provide the format for the required data while JAMB provides needed data for the operationalisation of the scheme. They also resolved to immediately set up a joint technical team to kick-start the process. At the end of the interaction the meeting recognized the critical role to be played by the Joint Admissions and Matriculation Board and resolved to recommend for the inclusion of the Board in the fund special committee rather than merely functioning in advisory capacity.

The meeting also resolved that every eligible candidate for the students loan should possess UTME/DE registration number and also to convey the resolutions of the meeting to other stakeholders listed in the Act as well as furnish the CBN team with any other information necessary.

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com