Nigerians in Diaspora cannot currently transfer a lot of funds home because of a harsh global economic condition, a report from Western Union has revealed.

The report titled, ‘Global Money Transfer Index: Uncovering consumer expectations of the remittance industry (The Africa Series)’ stated that this is as most remittance receivers in the country revealed that they will need to get more money from senders due to a cost-of-living crisis.

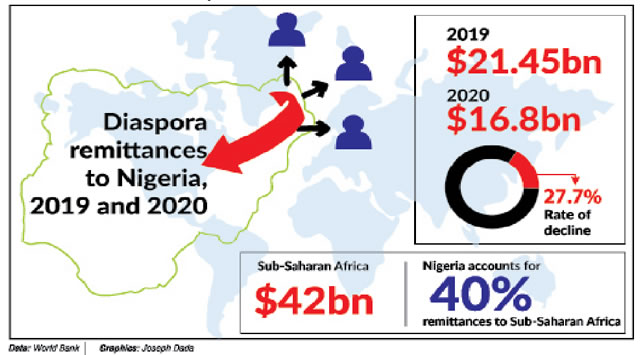

The report revealed that remittance inflows into the country were estimated to be $21bn, making it the largest receiving market in Africa, and the ninth largest in the world. It noted that two in three consumers (63 per cent) of the Nigerians who took part in its survey stated that they collect funds at least once a month, with 70 per cent also transferring money abroad at the same rate.

Remittance is expected to increase in 2023 because of increases in the price of things, but this increase is across the board affecting both senders and receivers.

Western Union said, “These figures seem set to grow in 2023 as a large majority of receivers (85 per cent) say they need to get more money from senders amid the cost of living crisis. This rises to 88 per cent of those aged 35 to 44, but drops to 73 per cent of consumers aged 55-plus.

“Senders too generally agree they must transfer bigger sums in the 12 months ahead (82 per cent). However, they face a problem: three-quarters (75 per cent) of them — increasing to 84 per cent of senders aged from 18 to 24 — say global economic conditions mean they cannot transfer as much currently as they did in the past.”

The Regional Vice President, Africa at Western Union, Mohamed Touhami El Ouazzani, opined, “Economic headwinds have impacted all consumers globally, and remittances play an integral role in ensuring people and their communities can keep moving forward, leveraging opportunities.

“Now more than ever, it is incumbent on us as money transfer providers to be agile, supporting consumers as their requirements evolve in order to manage their daily financial needs.”

In its index report, Western Union noted that Nigerian consumers’ behaviour was influenced by currency fluctuations which include increasing, reducing, or delaying forwarding funds depending on the value of the naira.

It further revealed that the adoption of digital money transfer services in the country was strong. The firm noted that its Nigerian consumers were calling for greater innovation from money transfer providers to support their remittance needs.

Ouazzani added, “Nigeria’s Government and Central Bank’s efforts in developing the necessary infrastructure has boosted connectivity and inclusivity.

“As a result, consumers have become attuned to the opportunities and flexibility innovations can bring. We expect this to continue, underscored by a strong emphasis on speed, convenience, and reliability.”

Share your story or advertise with us: Whatsapp: +2347068606071 Email: info@newspotng.com